net investment income tax 2021 proposal

This imposes a 3 tax on. Of particular importance for sellers the surcharge on income in excess of the applicable thresholds coupled with the expansion of the 38 net investment income tax to apply to gain from the sale of limited partnerships or S corporations could increase the tax liability on a portion of the gain recognized for transactions that close during 2022 or later by as much as.

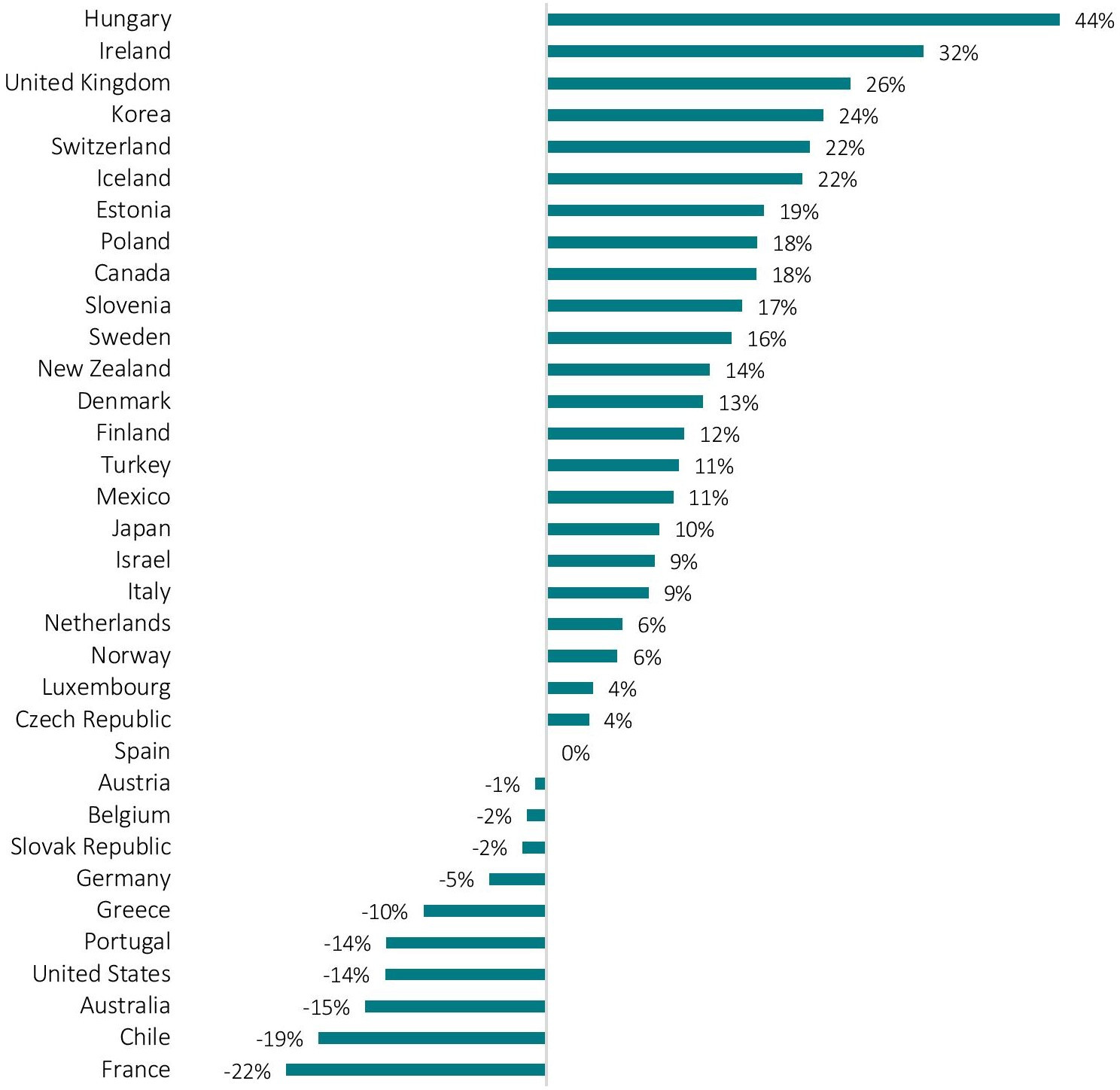

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

3 This includes a 25 long-term capital gains tax rate a.

. 1 day agoIncluded in net income for the first quarter of 2022 are the after-tax amortization of the cost of reinsurance of 132 million 006 per diluted common share and a net after-tax investment loss. Net operating losses would no longer be accounted for in determining NII. Net Investment Income Tax NIIT NIIT generally applies to investment income where a taxpayers modified adjusted gross income exceeds.

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. Fortunately there are some steps you may be able to take to reduce its impact.

Instead based on our reading of the latest proposal we are left with the following material changes to current tax laws. Fortunately there are some steps you may be able to take to reduce its impact. Expansion of Net Investment Income Tax.

The Build Back Better Act proposes the new net investment income NII to be 38 tax for trade or business income for taxpayers earning more than 400000 annually 500000 for married filing jointly. Plan ahead for the 38 Net Investment Income Tax by FPA Admin Jun 8 2021 Uncategorized 0 comments High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS.

250000 for joint filers. Fortunately there are some steps you may be able to take to reduce its impact. Net investment income includes interest dividend annuity royalty and rental income unless those items were derived in the ordinary course of an active trade.

Income and Investments. This proposal would be effective for taxable years beginning after December 31 2021. Plan ahead for the 38 Net Investment Income Tax Jun 4 2021 Individual Tax High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income. The NIIT applies to you only if modified adjusted gross income MAGI exceeds. At first blush the proposal appears to create two parallel systems.

All About the Net Investment Income Tax. Enacts a 5 surtax on modified adjusted gross income over 10000000 and an additional 3 surtax on modified adjusted gross income over 25000000 versus a 3 surtax on incomes above 5000000. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

Plan ahead for the 38 Net Investment Income Tax 612021 Highincome taxpayers face a 38 net investment income tax NIIT thats imposed in. A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after September 13 2021. The amount subject to the tax is the lesser of your net investment income or the amount by which your MAGI exceeds the threshold 250000 200000 or 125000 that applies to you.

The NIIT applies to you only if modified adjusted gross income MAGI exceeds. The 38 Net Investment Income Tax under Internal Revenue Code Section 1411 would be broadened to include any income derived in the ordinary course of business for single filers with more than. Application of Net Investment Income Tax to Trade or Business Income of Certain High Income Individuals.

The proposal would expand the 38 net investment income tax NIIT to active business income for taxpayers with taxable income greater than 400000 for single filers and 500000 for joint filers. 1 This includes the top individual tax rate of 396 a 3 surtax on individuals with modified adjusted gross income exceeding 5 million and a 38 net investment income tax that covers net investment income derived in the ordinary course of a trade or business. This expands the net investment income tax to cover net investment income derived in the ordinary course of a trade or business for high-income taxpayers.

Surcharge on High Income Individuals Trusts and Estates. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. July 7 2021.

This tax only applies to high-income taxpayers such as single filers who make more than 200000 and married couples who make more than 250000 as well as certain estates and trusts. Single individuals with modified adjusted gross incomes in excess of 200000 and married individuals filing jointly with modified adjusted. 200000 for single tax filers.

In addition to investment earnings and passive income under the current law the net investment income tax would also apply to net business income for taxpayers with taxable income greater than 400000 single or 500000 joint. In Income Tax Individual Tax Tax Tips. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income.

This treatment would apply to sales on or after the date of the proposal ie September 13 2021. In general net investment income for purpose of this tax includes but isnt limited to. Qualified Small Business Stock.

2 Includes the 38 net investment income tax. Plan ahead for the 38 Net Investment Income Tax. Trusts and estates will be subject to lower thresholds at.

Net Investment Income Tax NIIT on S Corp Profits If MAGI exceeds 500000 for a joint filer or 400000 for a single filer S Corporation profits will be subject to the 38 NIIT. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. NET INVESTMENT INCOME.

Net investment income tax. Plan ahead for the 38 Net Investment Income Tax. Long-term capital gains and qualified dividends are currently taxed at a top rate of 20 depending on taxable income and filing status.

Long-term capital gains and qualified dividends of taxpayers with an adjusted gross income of more than 1 million would be taxed at ordinary income tax rates with 37 generally being the highest rate 408 including the net investment income tax but only to the extent that the taxpayers income exceeds 1 million 500000 for married. The top individual tax bracket remains 37 versus an increase to 396. The proposal would repeal IRC Section 1061 for taxpayers with taxable income from all sources over 400000 and would be effective for tax years beginning after December 31 2021.

Performance Measurement Inrev Guidelines

What Is The The Net Investment Income Tax Niit Forbes Advisor

Operating Profit Improved Presentation Coming Soon The Footnotes Analyst

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Mini Business Plan Template Best Of Growth Strategies For Your Business Free Business Proposal Template Business Proposal Template Business Plan Template Word

House Democrats Tax On Corporate Income Third Highest In Oecd

Tax Proposals Under The Build Back Better Act Version 2 0

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

مركز الاستثمار الشخصي بورصة لندن In 2021 Investing London Stock Exchange Stock Exchange

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Tax Facts On Individuals 127th Edition Ebook In 2021 Business Ebook Health Insurance Humor Small Business Accounting

Formula For Calculating Net Present Value Npv In Excel Excel Formula Calculator

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Excel Business Valuation Template Business Valuation Excel Templates Business Analysis

Free Editable Startup Funding Proposal Template Word Template Net Startup Funding Proposal Templates Up Proposal

Like Kind Exchanges Of Real Property Journal Of Accountancy

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay